The memory price trend brings dynamic energy to the market, and the Nanya Science and Technology and Huabon Electric Market continue to watch the operation of the market.

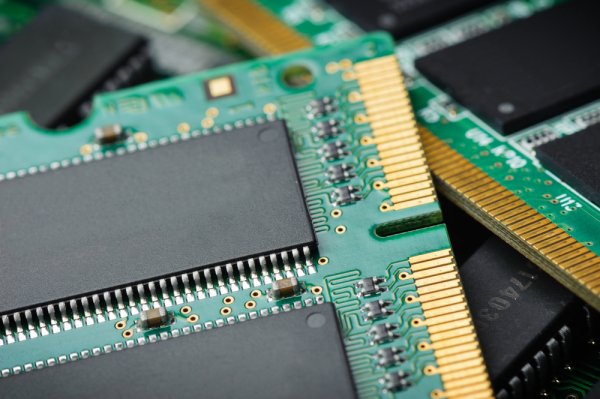

Recently, the supply and demand of the memory market have changed dramatically, and the NAND and DRAM markets have been booming simultaneously. Micron, the world's third largest memory manufacturer, will suspend bidding for one week starting from the 12th and notify customers of the closure. It is estimated that the subsequent price may increase by more than 20%. The industry has also proved it and is optimistic that after Micron launches its first price gun, the market will set off a new wave of stocks, and the growth will be expanded from DDR4 to DDR5.

DDR4 market demand continues to be strong, and the third quarter operation performance of the domestic memory factory Nanyake, a large domestic memory factory, has been better than market expectations. Since the new quarter of July, the contract prices of DDR4 8Gb particles and SODIMM have increased significantly. Coupled with the customer's extremely reserved goods, the volume has increased significantly. Looking ahead to the fourth quarter, with the continued tight supply, the company's DDR4 8Gb contract price is expected to maintain quarterly growth. The company has now been able to produce DDR4 8Gb products, among which the 1b process is larger due to the production total volume of 20 nanometers. With the increase in yield, it is expected to further improve the overall profit.

Benefiting from the rebound of DRAM prices, Nanyako closed 6.763 billion yuan in August, a monthly increase of 26.35% and an annual increase of 141.32%, marking a new single-month high in the past four years. The cumulative revenue in the first eight months of this year reached 29.829 billion yuan, an increase of 19.45% year-on-year. The President of Nanya Science and Technology said a few days ago that as the DRAM market stopped falling and rebounded in June, the third-quarter contract price judgment has been smooth, and with full capacity and rapid inventory sales, I am confident that the gross profit margin will be positive this quarter. Although it still needs to work very hard to turn the profit in the single quarter, it is emphasized that there is a chance of operating in the fourth quarter and will be oversold throughout the year.

As AI drives large-scale computing and storage needs, as international factories can accelerate their transformation to AI-related HBM, DDR4 supplies the price of shrinking belts to strongly move. The legal person believes that the traditional memory environment is being completely overturned, especially the DDR4 product. As international factories such as Samsung, SK Hynix, Micron and Changxin Cash are gradually shrinking, the supply is rapidly shrinking.

Huafang Power invested in new production lines, focusing on 8Gb DDR4, and its price rose by 60% in the third quarter, and continued to rise by 20% in the fourth quarter. Compared with the trough in the second quarter of this year, the cumulative increase has approached 90%. The legal person pointed out that Huafang Electric has pricing advantages in DRAM and is expected to become the main beneficiary of the price increase cycle. In addition to DRAM, SLC NAND has also continued to rise in the second half of the year. The new 24-nanometer process has begun initial delivery, and the legal person judges that it will invest greater contributions in 2026. Due to the high cost of materials and sealing, NOR Flash also reported in the fourth quarter, and the revenue scale of Huabon Electric's 45-nanometer NOR product is expected to continue to expand.

Benefiting from the increase in DRAM prices in the second half of the year, Huafang Power's operation has increased slowly and increased by 7.013 billion yuan in August, a monthly increase of 2.56% and an annual increase of 0.21%. According to foreign investment analysis, DRAM suppliers have begun to sign strategic contracts with major customers, and the price is even 200% higher than Huafang Power's price in early July, indicating that the market supply and demand are tight, and it is estimated that Huafang Power is expected to convert profits in the fourth quarter.